Royal Caribbean reported its third quarter 2016 financial results on Friday, which included higher-than-expected quarterly profit attributed to strong demand for North American cruises and increased onboard spending.

Continued strength in demand for North American cruises was a key driver for Royal Caribbean's strong quarter, with the rest of the itineraries performing within expectations. This strong demand helped offset the impact from the delay in opening Empress of the Seas sailings in the fourth quarter. Onboard revenue growth continued to outpace net yield growth, even after an extraordinary outperformance last summer. In addition, favorable trends in both currency and fuel helped the quarter.

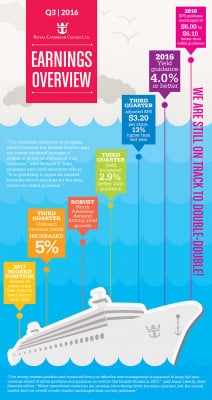

Net revenue yields, which take into account spending per available berth, rose 0.4 percent for the third quarter ended Sept. 30.

Royal Caribbean's net income rose to $693.3 million, or $3.21 per share, in the quarter, from $228.8 million, or $1.03 per share, a year earlier, when the company took a non-cash charge of $399.3 million related to its Pullmantur brand.

Total revenue rose 1.6 percent to $2.56 billion. Analysts on average had expected a revenue of $2.58 billion, according to Thomson Reuters I/B/E/S.

Excluding items, the company earned $3.20 per share, beating analysts' average estimate by 10 cents.

At this time, 2017 itineraries are booked ahead of last year in both rate and volume. New ships including Harmony of the Seas and Ovation of the Seas are seeing strong trends, supporting a solid outlook for 2017.