Everything new and different coming to Utopia of the Seas, according to Royal Caribbean's top dreamer

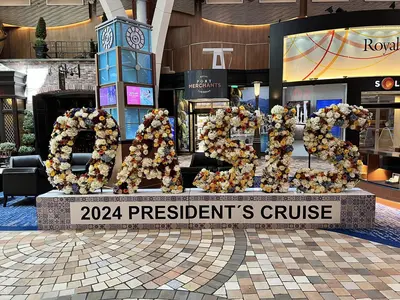

In:Royal Caribbean just revealed everything that will be new and different on Utopia of the Seas.

Royal Caribbean's latest iteration in the Oasis Class will sail mainly weekend and 4-night cruises out of Port Canaveral. The idea is to offer the ultimate weekend vacation.

Despite Utopia being the sixth ship within the Oasis Class, there are still a lot of tweaks, changes, and additions to this ship.

As the newest ship in the fleet, Utopia of the Seas exhibits a lot of changes that prove how the cruise line is always improving its vessels.

The 5,668-passenger ship features an exhilarating display of amenities, from thrilling waterslides to the brand-new immersive train car dining experience.

Jay Schneider, Royal Caribbean's Senior Vice President and Chief Product Innovation Officer, introduced Utopia's additions and changes during a webinar today.

Here are the top differences you can expect to find on Utopia of the Seas.

First-ever outdoor seating for Giovanni's

Jay Schneider called Utopia's Giovanni's "the best in the fleet."

Taking the place of a two-story Wonderland on Decks 11 and 12, Giovanni's Italian Kitchen and Wine Bar will be the first specialty restaurant to have outdoor seating.

"What we're probably most excited about is our outdoor alfresco," Schneider said.

The outdoor seating will be perched over the Boardwalk.

Double the hibachi and an expanded Izumi

Utopia of the Seas will also have an expanded Izumi, allowing for double the hibachi capacity.

During the webinar, Jay Schneider shared that Izumi "will have double the hibachi, a new omakase, and an expanded sushi experience."

The Izumi in the Park takeout window, first introduced on Icon of the Seas, will also be featured in Central Park.

Guests will be able to grab sushi and ice cream directly from this window.

Read more: Utopia of the Seas restaurant and dining guide

The Pesky Parrot is replacing the Bionic Bar

Royal Caribbean is ending the Bionic Bar in its Oasis Class ships.

"It was really fun and novel when it came out, [but] the Bionic Bar is ten-plus years old," Schneider explained.

Plus, human bartenders can make nearly 40 times the amount of drinks robotic ones can in the same time period.

Instead, Royal Caribbean has introduced a reimagined tiki bar in a classic Floridan style.

Schneider called it a "really fun, highly interactive, loud, vibrant" experience.

Additionally, there will be a real parrot inside the bar! Guests are encouraged to go inside and meet "Brian the drunk parrot."

Expanding Park Café

Park Café continues to evolve. Royal Caribbean is expanding the complimentary venue's hours and food offerings.

The concept will be blended even closer into Central Park.

Multi-story Lime and Coconut Bar

Royal Caribbean wanted to continue to develop its open decks on Utopia of the Seas.

"Utopia's open deck will be the best in class," Schneider said.

To this end, the Lime and Coconut will be taken to a new level, with a multi-story design and access from both the forward and aft ends.

Read more: Royal Caribbean reveals shows and parties for its new mega cruise ship

Expanded Sprinkles

Pool-goers love grabbing ice cream cones at Sprinkles, the complimentary ice cream venue located near the pool deck.

On Utopia of the Seas, this area is also getting an upgrade.

The area has an improved, larger design, and Royal Caribbean is introducing sprinkles on the ice cream for the first time.

Finally, Sprinkles will have sprinkles!

The Spare Tire

Based on guest feedback, Royal Caribbean wanted to add more complimentary food close to the pool and the open deck.

On Icon of the Seas, the AquaDome Market was introduced.

In the case of Utopia of the Seas, Royal Caribean is adding The Spare Tire, the line's first food-truck-style eatery.

According to Schneider, "In addition to El Loco Fresh, there will be great complimentary food handed out from The Spare Tire right on the open deck."

Extended Ultimate Abyss to remain the largest dry slide at sea

To stake its claim as the largest dry slide at sea, the Ultimate Abyss has been extended 43 feet.

In addition to that, designers have made the slide even more thrilling.

Passengers will feel like they're flying right into the Boardwalk before they turn at the last minute.

Redesigned Vitality Spa and Salon

Utopia of the Seas will have a reimagined Vitality Spa.

"We've really elevated the design," and Schneider says the cruise line is very excited about it.

The salon area will also have a new design.

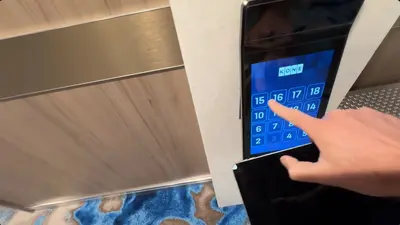

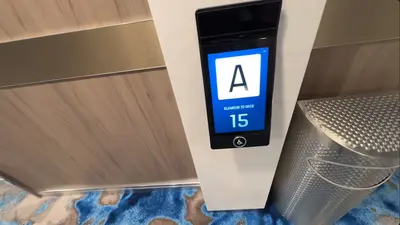

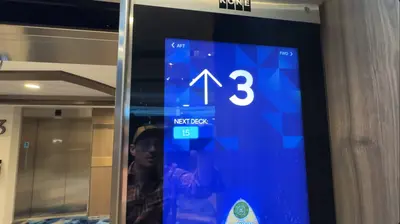

Upgraded destination elevators

Cruisers love the destination elevators as a solution to crowding on giant cruise ships.

This computer-assigned alternative ensures that the elevator doesn't stop on every single floor.

The destination elevators were a popular addition on Icon of the Seas, and have been confirmed as available on Utopia as well.

Solarium suites

Solarium suites are brand-new staterooms coming to Utopia of the Seas, located above the bridge wings on the ship.

Each suite has 270-degree views of the ocean, essentially the same view the captain gets.

Whether at sea or pulling into ports, guests will have that amazing, sweeping sea view from both the bedroom and the main living area.

The Royal Bling store

There will be a Royal Bling store on Utopia, but it won't be its own dedicated space like on Icon of the Seas.

Instead, Royal Bling will be a niche located inside the Effy store.

Icon of the Seas introduced the Royal Bling product as a way to offer special Royal Caribbean jewelry.

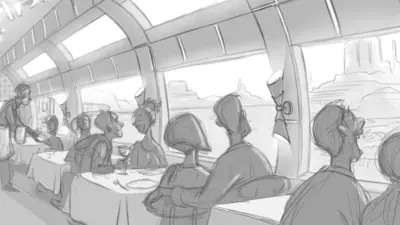

The Royal Railway—Utopia Station

Royal Caribbean guests love a classic dinner and a show, or what Jay Schneider likes to call "eatertainment."

To appeal to this desire and bring something unique to Utopia, designers came up with the idea to bring a train car dining experience to the ship.

"What if we put a train on a cruise ship that could take you to more destinations?"

This brand-new dining experience will be a completely immersive adventure.

Guests will receive a real train ticket in their stateroom, which they must bring to the dining venue.

The area has a classic train station platform, with separately numbered dining cars, and real train steam.

Schneider explained that the goal is to blend entertaining performances with amazing culinary dishes.

Passengers will be able to interact with actors dressed up as Wild West characters.

Once the train leaves the station, guests won't be able to "board" their car, so you'll have to show up on time.

Everyone will be called "all aboard," and the train will leave the station, immersing guests in gorgeous Wild West scenery.