Royal Caribbean Blog Podcast Episode - Nassau Beach Club preview

In:Royal Caribbean will open a beach club in Nassau, Bahamas and here's what Matt thinks of what we know so far.

Share with me your thoughts, questions and comments via...

Royal Caribbean will open a beach club in Nassau, Bahamas and here's what Matt thinks of what we know so far.

Share with me your thoughts, questions and comments via...

It turns out the amazing deal Royal Caribbean has for a new VIP pass was indeed too good to be true.

Over the weekend Royal Caribbean added a new package to its website that appeared to be a new extra cost pass. It included WiFi, exclusive tours and more at a bargain price.

Unfortunately, it was too good to be true.

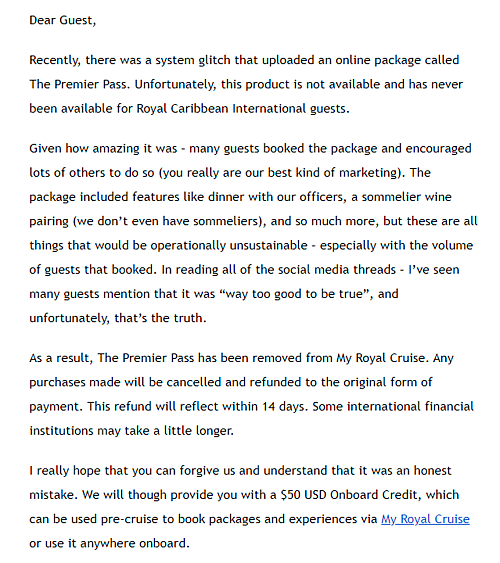

On Monday, Royal Caribbean sent guests an email to inform them that Premier Pass was a "system glitch" and was never intended to be put on sale in the first place.

Premier Pass listed all sorts of benefits, such as dinner with an officer, internet access, and more.

Royal Caribbean removed the Premier Pass option, cancelled all purchases, and will issue refunds.

In the email sent to guests that purchased Premier Pass, the cruise line admitted the benefits sound incredible, but are, " all things that would be operationally unsustainable" to actually offer.

Royal Caribbean International Assistant Vice President of Guest Experience, Aurora Yera-Rodriguez, wrote in the email, " In reading all of the social media threads – I’ve seen many guests mention that it was “way too good to be true”, and unfortunately, that’s the truth."

The email alludes to the fact so many people purchased the pass simply by way of word of mouth, which also made it impossible to carry through with.

Royal Caribbean is offering guests $50 USD Onboard Credit as a way of making up for the mistake.

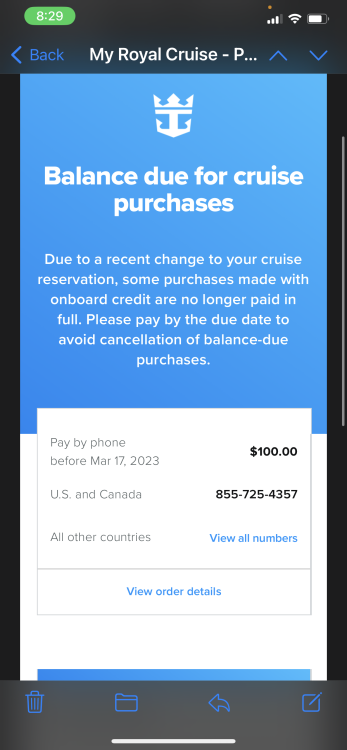

Unfortunately, it looks like some people got more onboard credit than they should have received, because the system gave them $50 per person initially.

Anyone that spent the money immediately on a new purchase, received an email to inform them that the purchase they made was no longer paid in full and they needed to make up the difference.

"Just got the same email- now I OWE Royal $100!!," is what Carlyn3 posted after encountering the onboard credit error.

As soon as the emails went out, cruisers shared their thoughts on the mix-up.

On the Royal Caribbean message boards, there were plenty of comments on the cancellation.

Rakaia wrote, "Hey, $50 I didn't have before. I'll take it."

Montemy2419 posted, "Nice of them to give the gesture because if they didn't give a little something then the backlash would of been bad."

Wilson wrote, "This is a hot mess."

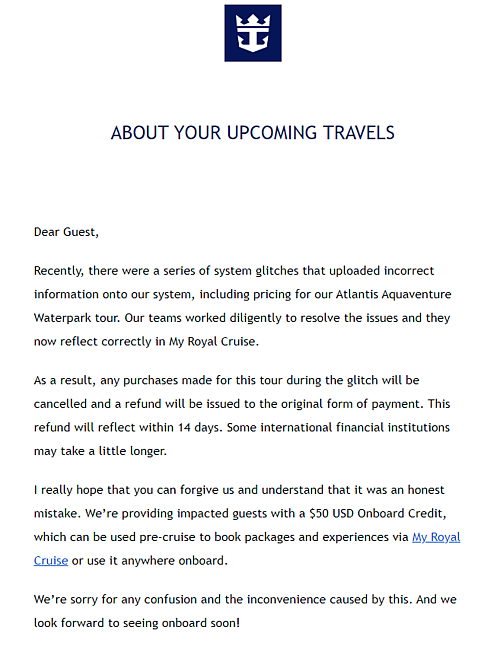

Minutes after the email was sent about Premier Pass, another email went out to anyone that booked an Atlantis Aquaventure Waterpark tour.

There was a price mistake for this popular Bahamas shore excursion, and purchases will also be cancelled and refunded.

Just like the Premier Pass, anyone that booked the Aquaventure at the mistake price will receive $50 USD Onboard Credit.

This week's issues are not Royal Caribbean's first notable internet sale error.

The most notable one was in 2019 when Royal Caribbean's website listed the Deluxe Beverage Package for $18 per day, per person.

At the time, the drink package was usually listed for $40-50 per person, per day (it now costs significantly more than that).

Royal Caribbean went on to honor that pricing goof.

Happy weekend! We hope you remembered to Spring Forward! Here’s all the Royal Caribbean news this week!

Royal Caribbean has moved forward with its beach club in The Bahamas.

The Royal Beach Club at Paradise Island will now open sometime in 2025, following the cruise line receiving approval from The Bahamas to move forward with the project.

The 17-acre destination experience will offer "the ultimate beach day" as it will combine the island’s striking beaches with the cruise line’s signature experiences.

The 490th episode of the Royal Caribbean Blog Podcast is now available, and shares why you might not want to book the cheapest cruise you can find.

It's tempting to find pick a cruise based purely on price, but there are a few reasons why you shouldn't.

Please feel free to subscribe via iTunes or RSS, and head over to rate and review the podcast on iTunes if you can! We’d appreciate it.

{"preview_thumbnail":"/sites/default/files/styles/video_embed_wysiwyg_preview/public/video_thumbnails/qkQ1L3DaLhg.jpg?itok=EC_s4aUa","video_url":"https://www.youtube.com/watch?v=qkQ1L3DaLhg","settings":{"responsive":1,"width":"854","height":"480","autoplay":0},"settings_summary":["Embedded Video (Responsive)."]}

Have you subscribed to the Royal Caribbean Blog YouTube Channel? We share some great videos there regularly, all about taking a Royal Caribbean cruise! This week, we are sharing our latest video — I spent $600 on cruise drink package & I think it was worth it! — and don’t forget to subscribe here.

An inside cabin will cost less than a balcony or suite, and it often makes a lot of sense to go with these kinds of rooms.

Inside cabins definitely aren’t for everyone, but Jenna prefers to stay in them for the great savings they provide.

From a quieter cabin to a perfect night’s sleep, she'll never complain about cruising in a cozy inside room.

From money saving advice to travel hacks to mistakes to avoid, here's our best advice on planning your first cruise.

Cruising is easier than it looks, but like any form of travel, there are lots of considerations and important do's and don'ts when it comes to doing it well.

Our guide will provide you the perfect place to start planning a first cruise.

Chantal spent 11-nights on Celebrity Edge to see what the fuss is all about this new class of ship.

Innovative, revolutionary, and bold are all words used to describe the first in the new class of ships from Celebrity Cruises.

Having never sailed on an Edge series ship, Chantal shares her thoughts on this kind of Celebrity cruise.

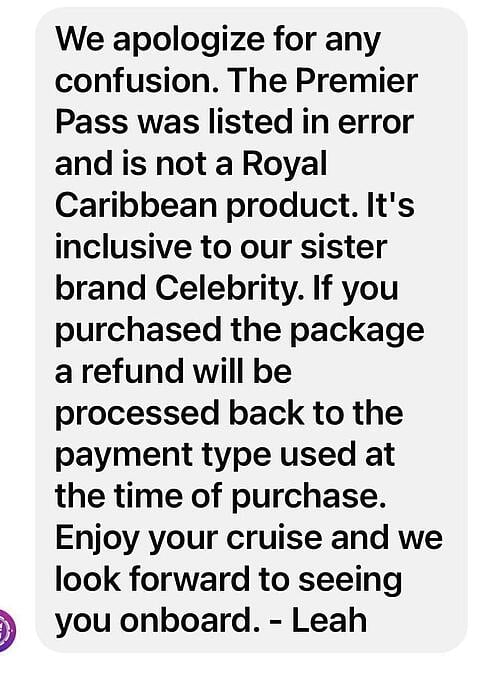

UPDATE MARCH 13: Royal Caribbean canceled and refunded any Premier Pass purchases.

UPDATE MARCH 12: It appears this package is a mistake and was never intended to be sold to Royal Caribbean guests.

On Sunday morning, Royal Caribbean's social media channels shared updates with guests that the package was mistakenly offered.

Thanks to Michael Poole for providing this screenshot.

---

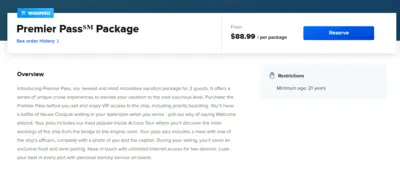

If you want to get an all-in-one add-on for your Royal Caribbean cruise that includes a bunch of extras, there's a new option for you.

Royal Caribbean is now offering Premier Pass, which is a new priority access program.

Royal Caribbean's original add-on perks package, The Key, is still available, but Premier Pass offers a different set of amenities aimed at offering the, "newest and most innovative vacation package."

Purchasing Premier Pass gets you VIP access, internet access, and service amenities you might not otherwise get unless you stayed in a suite or had an upper echelon Crown and Anchor Society level.

Here's what's included with the Premier Pass:

Basically, it's a way to board the ship faster and get VIP treatment at select events.

This new package includes some perks of The Key, but excludes priority activity access. Instead, it has more experiences and tours as part of its deal.

"Introducing Premier Pass, our newest and most innovative vacation package for 2 guests. It offers a series of unique cruise experiences to elevate your vacation to the next luxurious level. Purchase the Premier Pass before you sail and enjoy VIP access to the ship, including priority boarding. You’ll have a bottle of Veuve Clicquot waiting in your stateroom when you arrive - just our way of saying Welcome aboard.

Your pass includes our most popular Inside Access Tour where you’ll discover the inner workings of the ship from the bridge to the engine room. Your pass also includes a meal with one of the ship’s officers, complete with a photo of you and the captain.

During your sailing, you’ll savor an exclusive food and wine pairing. Keep in touch with unlimited internet access for two devices. Look your best in every port with personal laundry service on board."

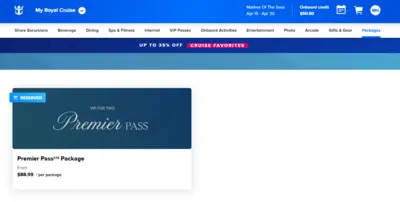

The new option is located under the "Packages" tab in the Cruise Planner, although I was only able to spot it for one of my upcoming cruises on Mariner of the Seas. RoyalCaribbeanBlog reader Bob Rogers spotted it for his Allure of the Seas cruise, so it's possible it's only available on select ships so far.

The cost of the Premier Pass is advertised for both of our sailings at $88.99 and it covers two guests.

You must purchase Premier Pass online before your cruise begins.

After a cruise is booked, go to Royal Caribbean's site, log in to your account and click on "Cruise Planner."

The appeal of any VIP package for a cruise is a way to enjoy added benefits without spending the money for a suite or having sufficient loyalty program points.

Buying Premier Pass gets you VIP benefits at a more affordable price, especially for new cruisers.

In short, the Premier Pass is all about getting exclusive benefits, if you value them. It's a way to feel like a VIP on your cruise, especially on embarkation and disembarkation day.

Like The Key, it's not essential to have, but it's certainly a nice add-on for those that want something special and wouldn't otherwise have similar benefits.

It appears thus far, The Key and Premier Pass will both be offered, as both options were available on sailings I was able to see Premier Pass listed.

Having not tried Premier Pass yet, it seems based on the description they are some benefits that are similar with most not.

First and foremost, one Premier Pass purchase is for two people, whereas The Key has a per-person price.

Additionally, The Key must be purchased prior to sailing by each guest age 6 or older assigned to the same stateroom. There is no such requirement of Premier Pass.

The Key is priced per night of the cruise, whereas Premier Pass is a fixed price for the entire voyage.

Both passes include Internet access for the duration of the cruise. Both will get you on the ship faster with priority embarkation, as well as priority disembarkation.

Beyond that, the list of benefits diverge from each other.

What's included with The Key

What's included with Premier Pass

Reserved times for shows and activities are at the heart of what The Key offers, whereas Premier Pass includes more experiences.

Are you an aspiring artist? Royal Caribbean wants to display your work on Icon of the Seas when it launches next year.

The cruise line has traditionally embraced art on its cruise ships, featuring impressive collections on each of its new ships.

Icon of the Seas is the next new cruise ship for Royal Caribbean and the cruise line has launched a new program that aims to look for up-and-coming artists from destinations the cruise line visits can vie to put their work on display.

Winners could get as much as $100,000 in commission budget if selected.

As its name suggests, Icon of the Seas was designed to be an icon – a symbol of luxury and comfort that guests can look forward to during their vacation.

Later this year, as artists in residence, the winners will work closely with the Newbuilding team behind Royal Caribbean’s renowned ships to bring their concepts to life in Turku, Finland, where Icon is under construction.

The "Artist Discover Program" has a goal to "infuse every region’s spirit and culture into the curated art collections on board ships, in order to highlight and celebrate the very destinations and their people at the heart of Royal Caribbean’s memorable vacations."

Royal Caribbean International President and CEO Michael Bayley thinks the new program will not only satisfy the cruise line's love of art, but also help promote burgeoning artists, "The Artist Discovery Program is a project close to our hearts at Royal Caribbean International because the destinations we visit are family. And it’s only fitting that we begin our search for up-and-coming artists who are in the Caribbean; it’s where we got our start more than 50 years ago."

"Vacationers want to immerse themselves in the places they visit. This is a way to spotlight the beauty of the local cultures and people in the places they see and enjoy every day on their cruise, beginning with large-scale canvases on a first-of-its-kind adventure – Icon of the Seas."

The program is starting off with looking for artists in the Caribbean. Local artists can send their submissions starting today and through April 4 via the program website.

To vie for a spot in the first edition of Artist Discovery Program, artists must submit the following:

If picked, each artist will receive a grant from the cruise line, ranging from $20,000 to more than $100,000.

The Caribbean Edition of the artists picked will be commissioned to paint nine large-scale murals in three highly visible locations:

1. Embarkation Murals: embarkation area passengers first enter when walking onboard Icon of the Seas.

2. The Royal Promenade: Main thoroughfare on Icon of the Seas that has shopping, dining, and things happening all day long.

3. Suite Sundeck: Private VIP area for suite guests only, boasts a bar, dining area, and pool.

Each piece will invoke the vibrancy of the Caribbean, joining the collection on board that will include an array of pieces created by Caribbean artists or inspired by the region.

Royal Caribbean's Icon of the Seas is the most highly anticipated new ship in 2024, and for good reason. Boasting an impressive gross tonnage and capacity, it's set to become the largest cruise ship in the world.

When Icon of the Seas launches in January 2024, she will be the first ship in a new class of vessels.

Icon will sail year-round, 7-night Eastern and Western Caribbean vacations from Miami.

The new ship will have 20 decks and manned by 2,350 crew members.

It's tempting to find pick a cruise based purely on price, but there are a few reasons why you shouldn't.

Share with me your thoughts, questions and comments via...

Ready to plan your first cruise but not sure where to start?

Cruising is easier than it looks, but like any form of travel, there are lots of considerations and important do's and don'ts when it comes to doing it well. After all, you're going to spend thousands of dollars on a vacation, so you ought to get the most out of the investment.

From money saving advice to travel hacks to mistakes to avoid, here's our best advice on planning your first cruise so you can set yourself up for a super fun vacation.

It's debatable what aspect of the cruise you should start with first, but I think it makes the most sense to pick which part of the world you want to visit on a cruise ship.

Royal Caribbean offers cruises to Alaska, the Caribbean, Europe, Asia and Australia. There are repositioning cruises and other sailings too, so there's lot of choices.

Many people that have never cruised before often have an idea in mind for where they want to sail to, so it makes sense to narrow your search to one region.

There isn't a right or wrong choice, but there's no sense in going somewhere you aren't that interested in visiting just because it's cheaper.

You may pick one region and then decide to change to another region because of prices, logistics, or some other factor. But it's easier to start with one area and plan from there.

More information

We'd all love to book the most extravagant suite on the itinerary that visits the coolest places, but money is the ultimate equalizer when it comes to vacation, so you need to be realistic about what you can afford.

Like any vacation, you probably have a ballpark idea of how much you're willing to spend and it's a good idea to have that number in mind when picking the right cruise for you.

The truth is that the price of a cruise can vary greatly depending on a variety of factors. For example, a 3-night weekend sailing for two adults can start as low as $550 for two adults. On the other hand, a splurge on an expansive multi-story suite could cost up to $80,000 for your entire family.

Of course, the cost of a cruise can vary depending on itinerary, ship selection, how long you sail for, how many people are joining you onboard, and when your chosen date is. It’s important to do your research and compare different packages before selecting the best option for you.

You'll need to not only consider the cruise fare, but also shore excursions, getting to and from the ship, and other incidentals.

A cruise is one of the best vacation values out there because of everything included in your fare, but you need to realize how much more is going to cost extra and be able to afford all of it. New cruisers may be surprised to find many extras not included in a Royal Caribbean cruise, such as drink packages, internet access, shore excursions, spa services and more.

Having a budget in mind will help narrow your choices when you select a ship or cabin.

More information

Royal Caribbean operates a fleet of almost 30 cruise ships, so you might be wondering how to pick the right cruise ship for you.

First and foremost, not every cruise ship is the same. In fact, many ships differ from their sister vessels of the same class!

There is no bad ship to pick, but you need to figure out which activities and amenities are important to you to figure out which ship has those.

In the first step, you determined which region you want to sail to, and that will dictate which subset of ships are available. If you want a summer Caribbean cruise, you may find many ships in Europe and that leaves you with less choices than a winter Caribbean cruise.

It's a good idea to make a list of the things you absolutely want to have on a cruise ship to help narrow the list. Some popular considerations include if a ship has:

There's plenty more, but these are the usual things people think about when choosing a cruise.

If you have kids, you might pick an Oasis Class or Quantum Class ship because of all the things there are to do for kids onboard. But if you're seniors cruising as a couple, those same activities might not matter to you.

More information

In your search, you may find one ship or sailing coming in significantly less than the rest. If you're like me, you might be wondering is there a good reason for one to be so much cheaper.

The pricing of any cruise relies on many factors, but usually it boils down to one of these:

In general, newer ships tend to cost more than older ships. This is just because newer vessels offer more to do, and they command a premium price.

In addition, certain homeports are less desirable than others. Cruises from Florida's east coast tend to have higher prices than cruises from Florida's west coast, or Baltimore, or Galveston. This is because newer and bigger ships are on Florida's east coast, whereas older ships tend to sail from the other ports.

The exact itinerary can also play a role in pricing, as there can be less demand for cruises that are longer than 7-nights. This has more to do with family's abilities to take that much time off school or work.

Related to your ship choice will be what type of stateroom you want to stay in.

There are lots of cabins across many categories. Rooms come in various sizes, layouts, views, and amenities. Just like the cruise ship, what matters to you is the important consideration here.

There are four basic types of cabin categories:

As you probably guessed, inside cabins cost the least but offer the smallest space and no outside views. A Royal Caribbean suite is the largest cabin with lavish furnishings and plenty of space, but will cost significantly more.

When it comes to selecting an ideal cabin for a vacation, there is no one-size-fits-all solution. Some people will prioritize price over luxury, and others will rationalize a vacation is worth a splurge.

In choosing the best stateroom, weigh these factors:

Your vacation budget may dictate which cabin categories are within reach. Someone on a tight budget may not be able to even consider a balcony or suite. But if you can spend more, then there's a wider range of choice.

For those looking to save money or make the most out of their time on board, an inside room might be the way to go. These rooms offer all the comforts of a traditional hotel room without having natural light or outdoor settings. Inside staterooms are generally more affordable than other options, but they still come with various amenities such as comfortable beds, private bathroom, and flat-screen television.

If you want to take in some ocean views while onboard, an oceanview room could be just what you’re looking for. These staterooms come with large windows that allow you to enjoy plenty of natural light during your stay.

Of course, a balcony room has indoor and outdoor space at usually a very affordable rate (compared to suites). You'll get a private balcony that you can enjoy at your convenience.

Finally, if you’d like the ultimate in luxury onboard experience then a suite might be the right choice for you. Suites come with extra amenities such as separate living areas and luxurious bathrooms equipped with spa-like showers or whirlpool tubs - perfect for taking some time out from sightseeing or partying! Plus many suites are located in prime locations on board giving you easy access to all that ship has to offer - from top-notch restaurants and bars to on-deck pools and entertainment venues.

If you’re going on a shorter cruise, it may not be worth investing in an expensive room – since you’ll likely be running around trying to enjoy as much as possible during your voyage.

But if you’re embarking on a longer journey, having a larger and more luxurious room can make all the difference in terms of comfort and relaxation. Having more space means being able to spread out and truly indulge in your cruise experience. You can take naps, read books or watch the beautiful landscape pass by from your private balcony – creating an unforgettable experience that will stay with you long after the ship docks back home.

More information

Cruise ship prices are advertised as being simple, but when you dig in there are some important things you should know.

The price of a cruise will vary widely. Inside cabins can cost just a few hundred dollars, while some suites go for as much as $75,000.

Almost any cabin you pick is based on double occupancy, so that means Royal Caribbean is assuming there will be two people in the room and charge you for each person. It doesn't matter how old these first two people are, the price doesn't change.

If you're looking to cruise by yourself as a solo cruiser, you will still have to pay a single supplement fee to make up for the loss of revenue from that second passenger in your room. While there are studio cabins that don't have a single supplement fee, they are few and far between.

When you choose a cabin, Royal Caribbean may give you the choice of you picking a cabin or letting them pick. By letting them pick, you'll get a guarantee cabin. This means you will not get any cabin of lesser category, but the cruise line will pick it later.

Guarantee cabins have an advantage of being cheaper, but the exact location is up to Royal Caribbean and you may end up with a room at the end of the ship, or an obstructed view.

The price of a cruise will include:

You optionally add gratuities or travel insurance to that cost. Then there's the extras we talked about earlier that are not included in your fare, such as wifi, beverages, excursions and more.

Equally important is the fare type you select. Royal Caribbean offers non-refundable and refundable cruise fare.

Just like an airplane ticket, non-refundable cruise fares are cheaper but come with penalties for cancelling or changing. Refundable cruise fares allow changes, but you'll pay more overall.

Before deciding on any cabin or fare type, pay special attention to the cancellation policy.

One of the top first time cruise mistakes is booking a cruise and wanting to change or cancel it later. There are strict policies related to changing your reservation, so check when final payment date is, and what sort of penalties come with changing your mind later.

Before you book anything, there are a few ways you could knock off a few hundred dollars or more from your total cost.

Try to book your cruise as early as you can because prices tend to be cheapest when booked early.

If you can book a cruise 6, 12, or 18 months ahead of time, you can really get a much better price than someone that books closer to the sailing.

Plus, you'll have a greater selection of cabins.

One of my favorite ways to save money is go on a cruise during times of the year that most others cannot go.

Every region cruise ships visit have a peak season, low season, and shoulder season.

Shoulder season is the time period between peak and low season when you'll find slightly cooler temperatures but at an affordable price point. This is a great option if you're looking for a balance between temperature and cost-effectiveness.

Prices will be higher in peak, and lower other times of the year. But there can be tradeoffs of cruising in lower demand times of year, such as temperatures, crowds, or precipitation.

If you're not picky about where your cabin is located on the deck, guarantee rooms can save lots of money.

Some people want to be in a specific location, but if you don't mind a longer walk from your room to the elevators, a guarantee cabin reservation might save a lot.

When you book a guarantee, you won't know your cabin location until closer to your sail date. There's no specific time Royal Caribbean will pick the room, as it could go right up until the day before your cruise.

Once you have your cruise booked, you'll want to tackle all the extra purchase you could buy.

Royal Caribbean gives guests two choices for its gratuities: pre-pay them before the cruise or get charged automatically every night of the cruise.

Gratuities are compulsory and cover your stateroom attendant and dining room staff. It does not include gratuities for other crew members or purchases, such as drinks or spa services.

The advantage of pre-purchasing gratuities is you lock in the gratuity rate (in case the price goes up later), and it's one less charge on your final bill at the end of the cruise.

Travel insurance is an optional add-on that you can buy through Royal Caribbean or on your own through a third party.

Like all insurance, travel insurance is probably a waste until you need it, and then, it's the best investment you've ever made.

Travel insurance doesn't cover every scenario, but it does help a lot if there's unforeseen circumstances that require you to cancel a cruise (especially at the last minute). Without it, you'll be left with a major penalty for cancelling and lots of money lost on a vacation you didn't go on. For piece of mind, I recommend travel insurance.

Next, you're up to the optional add-ons that can be purchased prior to the cruise on the Cruise Planner website.

You can buy drink packages, dining packages, wifi, excursions and many other extras, and buying them in advance will cost you nothing more than if you bought it onboard. In fact, many of these items are cheaper if you buy them before the cruise.

What to pack for a cruise seems to give a lot of first time cruisers a lot of anxiety because they are worried they will be ostracized for not being properly dressed.

Yes, there are dress codes on Royal Caribbean ships, but they're far less stringent than it seems on paper.

Consult a cruise packing list for a good starting point on what you need to bring with you.

Also keep in mind the weather you're going to, as warm weather destinations will need more comfortable and lightweight clothing than a cruise to a cooler weather climate. Packing for an Alaska cruise involves much more than packing for a Bahamas cruise.

Think about what your plans are for each port you will visit, as well as what to wear to meals at the ship's restaurants.

You should also be aware of what things you cannot bring on a cruise ship because they are prohibited.

More information:

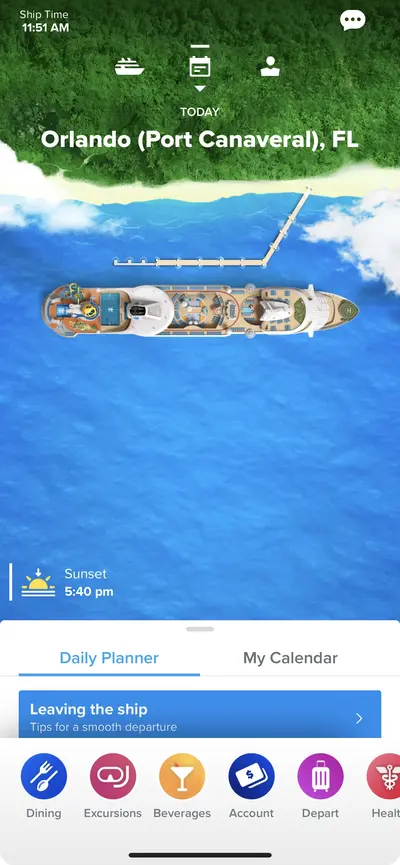

If you want to make the check-in process as fast and easy as possible at the cruise terminal, be sure to download the Royal Caribbean app and do the online check-in process.

45 days before the cruise sails, you can get a check-in time via the app. It's important to do this early to get a convenient time for you, and it's very simple via the app.

Use Royal Caribbean's app to do the check-in because the app has a a feature to scan your passport, saving you time from entering the information manually if you do it on a computer.

Completing all of these questions, and especially taking the photo, saves so much time in the cruise terminal.

Your cruise ship will visit at least one port, with most cruises going to more than one, so you'll want to have plans for the day there.

When a cruise ship visits a port, you don't need to have a tour booked. You could disembark the ship and walk around on your own, but not every port is conducive to this approach because often cruise ports are far from a city or cultural center.

Your best bet is to book a tour before the cruise begins to assure yourself of a spot, and have a plan locked in to avoid wasting time figuring out what to do.

Royal Caribbean sells its own shore excursions through its website before the cruise, as well as onboard the ship.

Excursions through the cruise line are curated and generally reliable. Nearly all are run by third party operators, but they are vetted by Royal Caribbean to ensure it meets certain criteria. Plus, booking them is super simple through the website.

Of course, tours booked through the cruise line will probably cost more because the cruise line is taking a percentage of the cost for themselves. Plus, tours offered by the cruise line are not necessarily indicative of every type of activity available.

At CocoCay and Labadee, you can only book tours through Royal Caribbean.

Alternatively, you could book a tour on your own.

In any port you visit, there are a myriad of excursion operators that you can book through. You can usually find out about most of them through an internet search.

When booking a shore excursion on your own, it's important to look up reviews of them to determine how reliable and reputable they are. You want to make sure they're not a "fly by night" operation, and that you'll be able to get back to the ship before it departs.

This is a good opportunity to remind everyone that the all-aboard time your ship has is a requirement to be onboard, or you will be left behind.

One advantage Royal Caribbean shore excursions have is if a tour is running late, Royal Caribbean will ensure you get back to the ship. If you book a tour on your own, it's up to you to figure out the logistics of getting back on time.

My advice is look at what Royal Caribbean offers and then look at what you can book on your own and determine the best option for you. There isn't a right or wrong answer whether to book a shore excursion on your own or through the cruise line. Each has its pros and cons.

Regardless of who you book your tours through, it's critical to book your shore excursions before the cruise because tours often sell out.

More information

It may have taken longer than originally planned, but Royal Caribbean is moving forward with opening the exclusive area in 2025.

The Royal Beach Club at Paradise Island will be the first Royal Beach Club, and it promises to be a compelling new option for cruise ship guests visiting Nassau, Bahamas.

Royal Caribbean had originally announced the beach club project in March 2020, but the cruise industry shutdown shortly thereafter left the venture in limbo.

Royal Caribbean received approval by the government of The Bahamas to move forward with the 17-acre project.

The new opening date is 2025, and Royal Caribbean promises more details, "will be revealed in the coming months."

Royal Caribbean International President and CEO Michael Bayley celebrated the news, "The Bahamas has been a phenomenal partner since the very start, when they became our first port of call more than 50 years ago."

"As we continue to bring millions of visitors to experience attractions throughout Nassau each year, The Royal Beach Club at Paradise Island is the next bold adventure in Royal Caribbean’s commitment to both increasing tourism in The Bahamas and delivering memorable vacations to our guests."

Not quite a private island, the Royal Beach Club is a new type of cruise ship experience that offers a curated beach day.

It won't be as secluded as Perfect Day at CocoCay, but it wont be something passengers on other cruise lines can enjoy either.

Royal Beach Club at Paradise Island will be located at the western end of Paradise Island. Cruisers will recognize this area as the same plot of land that the famous lighthouse near the Port of Nassau is located.

In today's announcement, Royal Caribbean describes the beach club as follows, "Alongside private cabanas, stunning pools and more, the vibrant Bahamian spirit and culture will come to life throughout the world-class destination experience."

"Vacationers will be welcomed by local architecture that complements the exceptional views of The Bahamas’ turquoise-blue waters and white sand beaches, along with experiences that feature Bahamian fare, island-style barbecues, live music and local artisans."

Royal Caribbean is designing this beach club as a public-private partnership in which Bahamians can own up to 49% equity in the beach club.

The beach club will be made up of 13 acres of land owned by the cruise line and 4 acres of Crown Land.

The Crown Land will be contributed as equity in the new venture to ensure a share of the profits return to the government and the people in a first-of-its-kind agreement in The Bahamas.

Local businesses and entrepreneurs will also have the opportunity to manage the vast majority of the experience.

The cruise line expects the beach club will generate hundreds of jobs between the construction and long-term operation.

This, in addition to a new tourism levy, will go into reinvesting in the local community. The collaboration between the government, the community and Royal Caribbean will continue as the development moves through the stages of planning and completion.

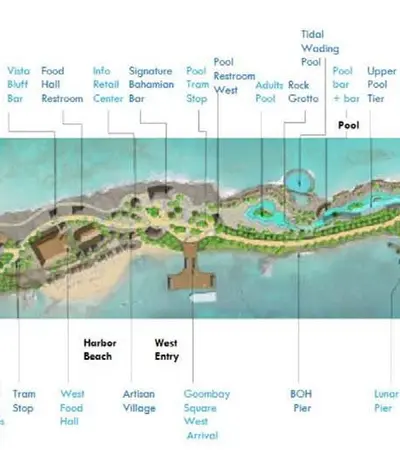

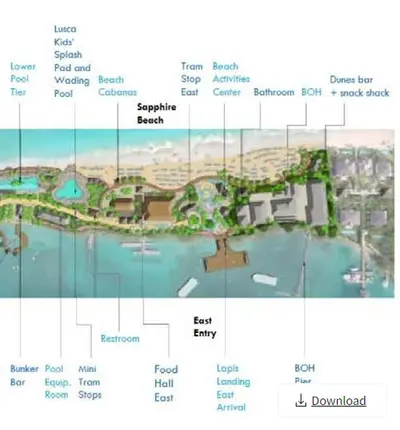

Based on Royal Caribbean's Environmental Impact Assessment (EIA) that it submitted, we have a possible idea of the plans are for this beach. Keep in mind the images and concepts shared here could have changed, but it's our best guess until more info is shared later.

Royal Caribbean wants to create a "world class beach experience" that has a family zone, arrivals area, water sports center, food and even a swimming pool.

The EIA mentions an entrance fee, so this will likely be an extra cost experience for cruise ship guests.

"It is anticipated that with the payment of an entrance fee, the experience will include access to the Royal Beach Club, lunch and the rental of a beach chair. For an additional fee, guests will be able to purchase alcohol and sodas, a cabana, day-bed, clamshell, and participate in watersports and local tours."

Activities offered would include (but not limited to):

The Conceptual Master Plan has a very low resolution image, but we can make out these features:

With cruise ship visits to Nassau that could last up to 9 hours, the Royal Beach Club experience will include four to five hours on Paradise Island plus additional time for shopping and other Nassau attractions.

For those with allergies and special diets, eating gluten free away from home can be a challenge. A Royal Caribbean cruise offers a stress-free option for those who need a gluten free diet.

There are many choices for anyone who is looking for options that fit into their restrictions.

In fact, Royal Caribbean can accommodate a host of dietary needs, such as Kosher, low-fat, low-sodium and gluten-free.

If you're someone who needs to eat gluten free on a Royal Caribbean cruise, here's what you should know.

In speaking with gluten free cruisers, they often talk about the variety of choices available.

First and foremost, you need to inform the waiter at any restaurant you visit that you are eating gluten free so that they can provide you options.

The biggest mistake someone can make is not saying anything and relegating themselves to what they can spot on the menu.

When you sit down at a restaurant, the waiter will usually ask first if anyone has any dietary needs or allergies.

Whether they ask you or not, always tell any waiter you are gluten free, just to be safe.

Past cruisers report there being lots of options and they will accommodate you to make sure you have a great experience.

Royal Caribbean ships have their own preparation area in the galley (ship's kitchen) away from the main production area to prepare meals for guests with allergies to avoid cross-contamination of meals.

In fact, the Food & Beverage staff attend recurring training programs regarding allergy protocols.

You don't have to inform Royal Caribbean in advance, but you can certainly do so prior to the cruise.

You can email [email protected] and/or call the cruise line at (866) 592-7225 to confirm your needs.

In the email, include the guests' names, booking number, ship name and sail date.

Whether you inform them ahead of time or not, it's a good idea to ask to speak to the head waiter once onboard about your diet. The dining room staff are great about working with you.

In the Main Dining Room, the staff will bring you the following evening's menu and you let them know in advance what you’d like that works for your diet. They also have gluten free bread that can be prepared.

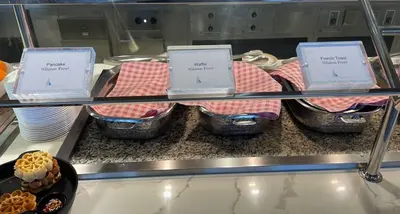

You can also make a request for breakfast the next day, such as pancakes or French Toast. They can also take lunch pre-orders as well.

The Windjammer buffet has great choices too if you're gluten free.

There's an entire gluten free section in the Windjammer you can choose from, in addition to any dishes you may find elsewhere around the buffet. There are gluten free buns for burgers too.

Don't be afraid to ask to speak to the chef in the Windjammer about what options you have beyond the designated section.

A common question is if someone with a gluten free diet is better off in the Main Dining Room or going to specialty restaurants.

In the Royal Caribbean Dining Facebook group, there are varying opinions on which is better, but neither are bad choices overall.

Both will be able to cater to your needs, so there isn't one that is a better choice than the other.

If you eat at a specialty restaurant, be sure to inform them of your special need.

One advantage of the Main Dining Room is you can specify your dietary needs on the first night, and the staff should be able to accommodate you going forward every day thereafter.

The good news is if you elect to try specialty dining, they can absolutely accommodate you.

You should know that you can still enjoy the complimentary pizza at Sorrento's (or Cafe Promenade/Park Cafe depending on your ship) if you're eating gluten free.

There is gluten free pizza available at Sorrento's upon request.

All of this sounds great, but what does it look like and what can you expect exactly?

Here are photos of gluten free dishes other guests have shared from their Royal Caribbean cruises.

Gluten free bread

Gluten free calamari

Carne Asada

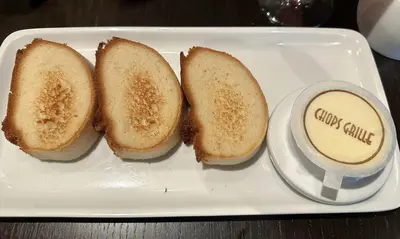

Gluten free bread at Chops Grille

Giovanni's Italian Kitchen with gluten free pasta

Chocolate torte

Tres Leches Cake

Royal Caribbean advises guests with special dietary needs to book Traditional Dining instead of My Time Dining in the Main Dining Room.

They say this is to provide the guests with a dedicated serving staff for the cruise.

As stated earlier, once you get onboard the ship, you should visit the dining room to introduce yourself to the dining staff.

You can advise them of your different allergies and they can then inform the dining staff for their table.

Food service can take a little longer due to food being prepared in a dedicated kitchen.

While you won't go hungry, it might be advantageous to have gluten free snacks in your cabin to munch on when you're in a pinch.

It can be difficult to know what desserts can be made gluten free, but here's a list of suggestions from reader Peggy Weatherington.

She dined recently on Wonder of the Seas and Oasis of the Seas and compiled a list of options.

Royal Caribbean's newest cruise ship doesn't launch until 2024, but you can see it already in Fortnite.

Royal Caribbean announced is has partnered with Fortnite to create a one-of-a-kind experience in the meta verse onboard Icon of the Seas called "Hide 'n' Sea."

What does this mean exactly?

Through the world of Fortnite, you can go ahead and virtually explore two brand-new neighborhoods onboard the highly anticipated cruise ship while collecting coins and playing hide and seek.

You will first have to download the Fortnite game and create a free account. Once you have completed those steps, you have to enter the Icon of the Seas in-game island code, 2569-9622-8657.

Fortnite is an online multiplayer video game that was released in 2017. In six years, over 400 million accounts have been created, and at any given time, there are roughly three million players online!

The heart of Icon of the Seas' purpose is to enhance the family vacation experience. This became evident with the new neighborhood concepts of Thrill Island and Surfside.

Since the majority of Fortnite players are under the age of 24, it appears as though they are trying to appeal to a wider audience and continue to build up the anticipation leading up to the ship's maiden voyage.

It is available worldwide on desktops, computer consoles, smart phones, and tablets.

Only two neighborhoods are included in this virtual world: Thrill Island and The Hideaway.

While you will not be able to get a full tour of the ship, you can explore the record-breaking Category 6 water park, as well as Crown's Edge, a fear-inducing adventure course that combines a ropes course, skywalk, and thrill ride into one jaw-dropping experience.

You can also see the Hideaway Pool, the world's first suspended infinity pool at sea, the fan-favorite FlowRider surf simulator, and Lost Dunes mini-golf course.

The game play takes place while the ship is at sea, so you are able to take in some great sea views while trying to locate other players or remain hidden!

Fortnite is known for their Battle Royale game mode, where you are dropped into a world and can fight against up to 100 other players. Hide 'n' Sea is less violent than other versions of the game.

To play, you either become a "prop" to hide from the sea-kers or are a sea-ker who is trying to find the hidden "props" in seven minutes.

Once the round begins, hiders have thirty seconds to conceal themselves before they transform into different props, including sun loungers, towels, or mini-golf flag.

You will win if you are able to successfully hide for the duration of the round or find all the "props." If you are a "prop," you can instantly win by collecting all 25 coins.

This is far from the first convergence of cruise ships and the online world.

In December 2022, sister brand Celebrity Cruises announced Celebrity Beyond cruise ship would be part of the Metaverse.

The game allowed users to visit the Resort Deck, along with other iconic spaces and bars. They could visit the Grand Plaza and see the cruise line’s flair show. A signature event onboard, mixologists perform tricks under a lit-up, moving chandelier to the delight of onlookers. They can also visit The Magic Carpet floating bar, the Grand and the Sunset Bar.